Kindly provided by Panorama Properties – www.panoramamarbella.com

Christopher Clover has been writing about the Marbella Property Market for over 50 years

This remarkable growth has extended to all sectors of the Marbella economy, including tourism, the op ening of new prestige hotels and restaurants, construction of new properties, refurbishment of older ones, and virtually all of the service and hospitality industries.

Many have described the heightened activity since the end of the pandemic as intense, almost frenetic.

The luxury market has seen historic levels, not only in property, but in all other sectors of luxury goods and services around the world. The top end of the market has been defying the pessimism present in some other economic market sectors.

While the pandemic has undeniably caused a lot of hardships for many people and sectors, the wealthiest have witnessed a record rise in their overall assets and wealth. According to Forbes, there are 2,640 billionaires as of May 2023. To put this into some context, this is almost 20 times the amount there were in 19871 . There is more liquidity among the wealthy today than ever before. This, of course, fuels the luxury property market not just in Marbella, but worldwide.

Or Ferrari. Between January and September of 2022 sold 20% more cars than in the same period the previous year.3 And the privately-held fashion and beauty giant, Chanel, saw sales rise 17% reaching $17 billion in 2022.4 While Richemont, who owns Cartier, Van Cleef & Arpels, Jaeger-LeCoultre and Piaget, among others, also reported historic sales in 2022.5

Almost everywhere we look, the same trend continues. LVMH Moët Hennessy Louis Vuitton became the first European company to reach a $500bn market value,6 while 95% of luxury brands overall enjoyed a positive compound annual growth rate in 2022. Travel is booming, five-star hotels are enjoying record occupancy around the world. Despite economic headwinds and a slow down this year in the American market, the luxury industry as a whole is set to grow—albeit a bit slower—as wealthy shoppers continue to travel and spend.7

It is the availability of world-class homes in the Marbella area which is unto itself, one of the primary motivational factors attracting luxury-end buyers.

Continuing a trend that started over six decades ago, Marbella has cemented its status as the quintessential resort destination appealing to both established wealth and the many new and emerging affluent who have bought homes in the area. But its appeal doesn’t stop there: just ask any of the many thousands of families from all over the world who have chosen to make Marbella their home.

At the top end of the property market, Marbella is attracting more and more buyers who are looking not simply for a holiday home, which is normally smaller than one’s permanent residence, but for a second or third “first home”, that is, a place they can live in several months of the year, or all year round if they so desire.

An address in Marbella has always been a symbol of international prestige, today more so than ever before. As our Mayor, Ángeles Muñoz, recently stated, “Marbella distinguishes itself from other resort destinations by offering a one-of-a-kind blend of world-class hotels, residential properties, services and facilities, solidifying our position as one of the most significant resort cities in the world.”

Every aspect of Marbella luxury real estate has undergone a fundamental transformation towards toplevel sophistication. While Marbella continues to attract individuals with traditional tastes from across the globe, new and renovated properties embody the epitome of luxury, world-class design, quality and cutting-edge technology. Indeed, it is the availability of world-class quality homes in the Marbella area which is unto itself, one of the primary motivational factors attracting luxury-end buyers.

The 2022 sales boom of properties in all price ranges in Marbella, Estepona and Benahavís – the “Golden Triangle” – broke all previous records with a 20% year-on-year increase in sales volume. The same happened throughout the country, with overall real estate investment in Spain up by one third compared to 2021 to reach €17.5 billion, a figure never before seen in Spain.8

Unfortunately, official statistics simply do not provide all the information which would be helpful in compiling this report, such as numbers of sales in different price categories, or even purchases off-plan or under construction. In these cases, we have to analyze the market more by tendencies, trends and informal interviews with other local agencies.

Sharp increases in interest rates in Spain and throughout the western world in the fourth quarter of 2022, as well as the preceding months’ record market highs, led to a peak in sales volumes on a national level, as well as in the Marbella area. But while the increase in interest rates has made buying homes more expensive overall, fewer than 10% of property purchases are made with a mortgage in Marbella’s luxury end of market – which we define as those properties with selling prices in excess of €2 million.

In fact, in 2023 so far, we are observing that the sale of luxury properties is even stronger than in 20229, with some agencies reporting an increase in sales of up to 20% in the highest-end of the market. We observe a similar continuing surge in prime and ultra prime real estate in London, Dubai and Miami. 10, 11, 12

In the chart above, we have compared first quarter sales statistics of the last several years, where the sales in the first quarter of 2023 still exceed those of pre-pandemic levels by 18%, clear evidence of a continuing strong market

According to the most important Spanish real estate portal, Idealista, the number of properties for sale on their portal has dropped on average 6% in the province of Málaga during the last year.13 A study performed by Idealista for Panorama found that the stock of properties for sale in Marbella dropped on average by 8.83% from the first quarter of 2022 to the first quarter of 2023, and up to 40% in certain key, prime or super prime areas. Clearly, and in accordance with the laws of supply and demand, a diminishing stock of properties coupled with an increasing demand always leads to an increase in asking and selling prices.

A diminishing stock of properties coupled with an increasing demand always leads to an increase in asking and selling prices.

Evidence of the shortage of new or refurbished properties for sale is the relatively small number of building projects approved in Marbella last year. Of the 7,075 residences approved by the Colegio de Arquitectos of Málaga in 2022, only 690 were for Marbella, whereas in Estepona there were 1,067, Mijas 909 and Benahavís, 157.14

Without a doubt, the main reason for the reduced number of project approvals in Marbella is the lack of fully-zoned building land, a problem dating back at least a decade. This has not only driven up fully-zoned land prices but also pushed property developers to buy development land in Estepona or Benahavís instead. Even though new, fully-zoned development land will come on the market with the definitive approval of the new general zoning plan of Marbella, expected in 2024 (already initially approved on 30 March, 2023), the time necessary for the development process indicates a likelihood of a continued shortage of properties for at least three, or four, more years.

Asking prices in all price categories in Marbella have risen, on average, by about 15% between June 2022 and June 2023, reaching a new all-time high of €4,233/m2 – approximately double the average asking price per m2 of 10 years ago.15 Although this figure does not represent real sales prices, it is an excellent orientation with respect to what the increase in real sales prices will have been on average in Marbella.

Average price statistics are available for the whole province of Málaga, with the Property Registry noting price increases for the whole province at 3.4% for new properties and 11.2% for resale properties.16 Official statistics for new properties are misleading, however, as they are only recorded when the title deeds are issued and therefore don’t include properties that are sold off-plan or under construction.

Marbella prices, even at today’s levels, are still very competitive: of the 50 most costly municipalities in Spain, Marbella is only number nine on the list...and globally Marbella is in 16th place, with Monaco leading as the most expensive city.

Predictions for selling prices

Predictions for selling pricesNotwithstanding the enormous price increases of the past two years, there is hard evidence that Marbella prices, even at today’s levels,17 are very competitive: Of the 50 most costly municipalities in Spain, Marbella is only number nine on the list, which is headed by Sant Josep de Sa Talaia in Ibiza, at €6,295/m2. Globally, Marbella is in 16th place, just ahead of Madrid and Dubai, as quoted in the Knight Frank 2023 Wealth Report, with Monaco leading as the most expensive city to buy prime property in the world, at an average sales price of over €50,000 per m2.

As a general rule of thumb, prices for new or refurbished luxury apartmentsin the Marbella area start at €6,000/m2and go right up to €25,000/m2 in the most sought-after beachfront areas of the Golden Mile, sometimes even higher in the case of certain unique properties. Prices for new or refurbished villas, start in the region of €8,000/m2 and go up to €14,000/m2.

According to an article published by the Bank of Spain in June 2023, despite the increase in mortgage interest rates, “due to the scarcity of new construction, the high costs of construction materials and the favorable financial situation of the different buyers in the market, the price of housing will continue to demonstrate resistance to decrease, in spite of the other variables in the residential market, such as sales volume or the number of properties approved for construction.”18

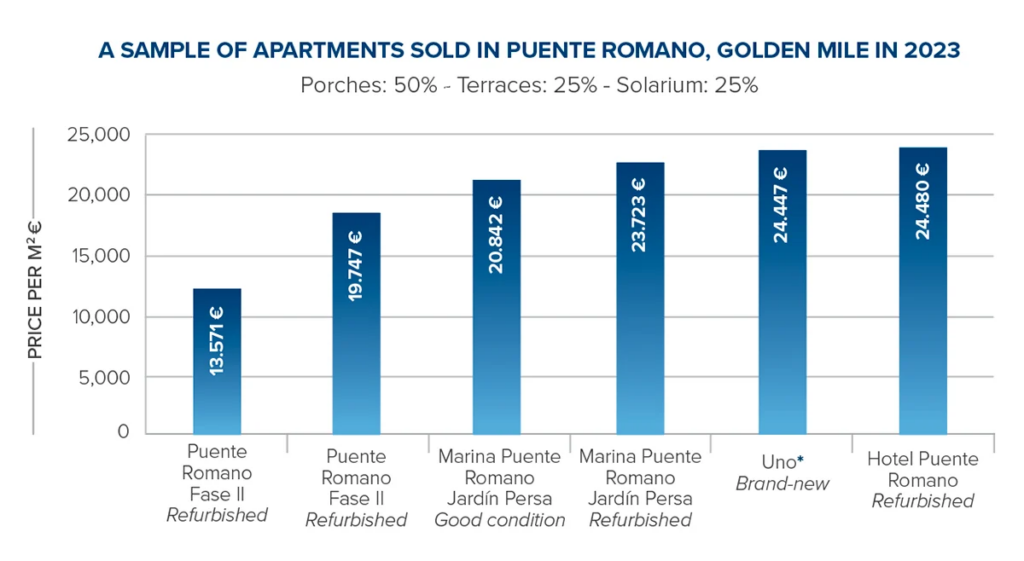

Nothing is better for price analysis than real selling prices. In these charts we have included real sales prices per square metre of a mix of typical properties sold in the first half of 2023.

Even with the post-pandemic surge quieting down, and inflation decreasing to a core rate of 5.9% in June 2023, we believe that prices will continue to increase, but the increases in the coming months will be more moderate.

WHO IS BUYING?

WHO IS BUYING?While purchases by Spaniards are ever-present, and represent the very foundations of the overall Marbella property market, at least 90% of the properties of over €2 million are sold to foreigners.

In the autonomous community of Andalucía as a whole, 15% of the home buying and selling transactions were carried out by foreigners, whereas that figure more than doubles to 34% in the province of Málaga.

By nationality, the British are still the principal buyers in our province of Málaga, accounting for 16% of all transactions, followed by the Swedish and the Dutch, at 12% and 8% respectively, with the Belgians, French and Germans not far behind.19

Noteworthy is the surge in the Swedish and Norweigan markets which have gradually been increasing their market share over the last several years. The last two years have seen the strong emergence of the Polish market as well as buyers from Eastern Europe, certainly as a reaction to the war in the Ukraine, but also for the same reasons as most others: the desire to change lifestyle to a warmer climate in a high-quality area of the southernmost tip of Europe, far from the problems and potential dangers of Central Europe.

Marbella has also been a favourite place for Middle Eastern holiday makers and property purchasers since the late 1970’s, and remains so today with many looking into buying a home not only for holidays but also as a means to obtain the Spanish “Golden Visa”. There are now direct flights to Málaga from Bahrain, Abu Dabi, Qatar, Egypt, Turkey, Kuwait and Saudi Arabia during the summer season.20

Since the beginning of 2022, due to the enormous increase in the strength of the dollar to the euro, there has been a marked increase of US citizens purchasing property in our area, exemplary of the spread of the fame of modern-day Marbella throughout the world. Direct New York–Málaga flights are now being offered by United Airlines, a reflection of this growing interest in Marbella and the Costa del Sol in general.

While purchases by Spaniards are ever-present, and represent the very foundations of the overall Marbella property market, at least 90% of the properties of over €2 million are sold to foreigners.

Branded residences are a partnership between a respected brand and proven, sophisticated developers where everyone benefits:

Leaders in the field of branded residences in Marbella today are the highly experienced developers Grupo Sierra Blanca, led by Pedro Rodriguez and his sons Carlos and Luis. They introduced the concept to Marbella with the phenomenally successful Epic by Fendi and Karl Lagerfeld Villas, and more recently the announcement of their association with Dolce & Gabbana21 for their new project Marbella Design Hills. This new project, significant in size and scope, includes approximately 90 apartments of the highest qualities, a commercial plaza with shops and restaurants, built on an 80,000 m2 site in the direct vicinity of their previous two other projects.

Leaders in the field of branded residences in Marbella today are Grupo Sierra Blanca, led by Pedro Rodriguez. They introduced the concept to Marbella with the phenomenally successful Epic by Fendi and Karl Lagerfeld Villas, and more recently with the announcement of their association with Dolce & Gabbana for their new project Marbella Design Hills.

The first ever Elie Saab Villas in Spain will commence construction shortly, in partnership with Urbania, starting with five villas on the Camoján Road.

The Banyan Tree will bring their vibrant concept to the hills overlooking Marbella with the opening of Angsana Real de La Quinta in 2026. In addition to 90 nature-integrated guest rooms and suites there will be Angsana Branded Residences with amenities such as a private courtyard, pool, daily housekeeping and maintenance services.

The Four Seasons development, designed by the world-famous architect Richard Meier, is planning to start construction in 2024. The project includes a Four Seasons Hotel of 165 rooms and suites, 260 private residences and 40 villas of the highest quality and design… all under Four Seasons management.

Marriott’s W brand is developing the W Resort Marbella, a €200 million hotel and residential resort in one of the last available beachside plots in the municipality. The project will include a luxury W hotel with 186 rooms, two buildings with 89 apartments, and an additional 109 upmarket residences, all managed by Marriot.

Tierra Viva is an impressive new development of 53 exclusive luxury villas, all with sea views and extraordinary design and finishes, located in Benahavís, in collaboration with Automobili Lamborghini. It represents the first project in Spain by Dar Global PLC, the international arm of Dar Al Arkan Development, the renowned publicly-owned Saudi real estate company.

In fact, the “branded concept” is extending not only to residences but also leisure: the landmark Puente Romano Beach Resort on the Golden Mile was the location chosen by Fendi to open their branded Chiringuito Beach Club and shop. And Marbella’s Michelin Star chef Dani García, together with the Mosh Group, teamed up with Dolce & Gabbana to create the relaunched La Cabane Beach Club in Los Monteros.

The evolution of Marbella has brought with it tremendous investments not only in new, branded residences and hotels but also in the renovation of older ones, in line with market trends over the last decades and the anticipation of the acceleration of these trends in the future.

The former medical hotel Incosol, inaugurated in 1973 by General Franco himself and closed almost a decade ago, is set to be restored by the Ilanga Capital group.22 The restoration is planned to be completed at the end of 2025, relaunched as a five-star luxury hotel complex with 160 rooms specializing in health and well-being, including out-patient and surgical facilities. More than €150 million will be invested in the project.

The Andalucía Plaza Hotel is now the Hard Rock Hotel. Originally inaugurated in 1973 by José Banús, it was acquired by Stoneweg Hospitality & Bain Capital Credit in 2021 and underwent a complete refurbishment before opening again in July 2022. It comprises 383 rooms and suites, and the design, finishes and decoration of the hotel have won several international awards.

Club Med Magna Marbella, the former Don Miguel hotel, opened to guests on 20 May, 2022. Marbella can now boast a new luxury family holiday resort with 14 hectares of gardens, five swimming pools, 485 rooms, several restaurants, 15 conference rooms and much more.

Also in July 2022 the Occidental Puerto Banús opened with 291 rooms. The old PYR Hotel in Puerto Banús near El Corte Inglés, was taken over by the Barcelo Hotel Group the year before and undertook an extensive refurbishment.

The Hotel El Fuerte, one of the very first hotels in Marbella originally opened in 1957 by Don José Luque Manzano, a pioneer in the hotel industry on the Costa del Sol, has undergone a major transformation costing over €30 million, converting it into a five-star hotel with 266 rooms reopened in May 2023. 23

La Fonda, a glorious small hotel in the Old Town of Marbella, which in the 60’s through to the 90’s was a favourite place of the “jet set”, has been totally refurbished at a cost of over €11 million. Built on the structure of three houses dating back to the 16th century, it comprises 20 rooms and suites, a gourmet restaurant, and many other facilities. It opened its doors as the first Relais & Châteaux property in Andalucía in April 2023.

The Hotel Los Monteros, a historic landmark hotel and one of the first five-star hotels of Marbella, owned by Stoneweg Hospitality, first opened in 1962, just received the building license for another refurbishment at a cost of €11.8 million. It will reopen its 178 rooms and suites next year under the luxury brand Kimpton, one of the exclusive brands of IHG Hotels and Resorts.

All these hotels join the many others, most of which have already been refurbished, such as Pinomar, Eurostar, San Cristóbal, Don Pepe, Estrella del Mar, Don Carlos and the Hotel Guadalmina.

In addition to the branded property developers and the modernization of virtually all the principle hotels in the area, almost every national and many international developers are involved in Marbella area real estate today.

In addition to the branded property developers listed above and the modernization of virtually all of the principle hotels in the area, almost every national and many international developers are involved in Marbella area real estate today, accompanying hundreds of smaller investors with projects of one or several units. A few of them are listed below:

Neinor Homes will invest €229 million in the province of Málaga in the next three years with the launch of 446 homes.24

Metrovacesa are investing €17.5 million in The Medblue II residential project consisting of 45 homes located in the upper part of Los Monteros.25

The Spanish real estate group López Real Inversiones will reform and renovate the “Marbel Center” shopping centre, with an investment of €25 million.26

Taylor Wimpey Spain has started construction on Marbella Lake in the heart of the Golf Valley, in Nueva Andalucía, where 98 apartments will see an investment of more than €35.5 million.27 In addition, they have recently launched a new project in Istan called Almazara Boutique Residences with an initial investment of €30 million.

Millenium Hospitality intends to develop 40 ultra highend apartments behind the Guadalpín Banús Hotel.28

Grupo Insur is investing €42 million into a new project located in Altos de los Monteros. Under the name of Quintessence, the project will see 96 homes all with fantastic views to the sea.29

The highly successful Spanish public company, Aedas, has bought land in Andalucía for the development of 5,000 homes, with an investment of €1.3 billion.30

Many other property developers, such as Azata, have been “land banking” for years. Azata has land for 5,000 units on the Costa del Sol alone.

A SUCCESSFUL MULTI-CULTURAL COMMUNITY

A SUCCESSFUL MULTI-CULTURAL COMMUNITYSurprisingly, Marbella has a larger official census than the Andalusian cities of Huelva, Jaén or Cádiz, with 161,870 in January 2023, and of these, 51,024 are foreigners of 135 different nationalities.

To this total we can add a significant additional unregistered, or floating, population of tourists and part-time residents of at least 150,000 more in the winter months alone.

“The number is growing day by day,” says Remedios Bocanegra, Councilor for Foreigners in the Marbella Town Hall. Marbella is an unusual example of a highly successful multicultural society, another reason for its sustained growth.

Surprisingly, Marbella has a larger official census than the Andalusian cities of Huelva, Jaén or Cádiz, with 161,870 in January 2023, and of these, 51,024 are foreigners of 135 different nationalities.

One of the best results of this influx of foreigners is seen in the service and hospitality industries, with Marbella registering the lowest unemployment rates in the month of June for 14 years.31 Clearly, with the increase in tourism, especially residential tourism, where people come to live in their own homes part of the year, the creation of stable, permanent jobs has resulted in the high employment rate Marbella enjoys today.

With a thriving economy, the municipal budget for 2023, at €333 million, is the largest in Marbella’s history.32 There are dozens of new projects underway aimed at improving the infrastructure and attractiveness of the area.

To give an example, the beginning of the Istán road is undergoing a complete renovation. Another example is the installation of the new sidewalks, street lamps and asphalt on the road leading to the Marbella Hill Club and La Capellanía. Attention is being given to almost every corner of the municipality as never before.

12 million square metres of rural land in the municipality will be re-designated as urban

THE NEW GENERAL ZONING PLAN OF MARBELLA

THE NEW GENERAL ZONING PLAN OF MARBELLAMarbella is expanding and urgently needs zoned land to do so, as indicated earlier. The Mayor recently announced that 12 million square metres of rural land in the municipality will be re-designated as urban. The new general zoning plan is expected to be approved during 2024.33

Regarding Nueva Andalucía, the Mayor said: “We have managed to recover more than half a million square metres of land to provide this area with new sports, health, cultural or social facilities”

Golden Mile and Nagüeles: There is much to be done in the area around Puerto Banús. The Mayor said that she wants to, in her words, “create a municipal environment linked to innovation and technology…with large residential spaces that at the same time are ideal for the flexible uses demanded by digital nomads.”

Furthermore, improvements on the AP-7 motorway are being considered, as well as the unblocking of the development of large, older urbanizations such as the Swedish Forest Centre.

Marbella Town: The new General Plan includes improvements for each neighbourhood in line with their individual needs, such as parking, urban regeneration and mobility.

Marbella East: Several new hotels and tourist projects are planned or under consideration. As the Mayor said: “this will be a key district in the economic growth of our town, always clearly preserving the coastline and improving connections to the A7 and AP7”. 34

TAX BREAKS FOR ANDALUCÍA

TAX BREAKS FOR ANDALUCÍAAlong with Madrid, Andalucía is the region with the lowest taxes in Spain. This has fostered continued foreign investment, leading to a capital growth rate of 40% over the last five years. Madrid and Andalucía have both enjoyed solid capital growth, and no other region in Spain has come close to achieving the same.

Among the tax advantages of Andalucía, are the virtual abolition of the gift and inheritance tax in most instances; the lowering of the property transfer tax to a flat 7% and of stamp duty to 1.2%, the abolishing of the wealth tax, and the lowering of income tax.

A “solidarity tax” was imposed by the national government on assets over €3 million but is being challenged in the courts as it is an additional patrimonial tax which should be the sole competence of the Autonomous Regions.

In addition to the popular Golden Visa program, the national government approved a tax free visa, known officially as the Digital Nomad Visa, allowing remote workers to reside in Andalucía for a period of five years and pay no tax on assets or money held abroad.

Along with Madrid, Andalucía is the region with the lowest taxes in Spain. This has fostered continued foreign investment, leading to a capital growth rate of 40% over the last five years.

Just as there is a disequilibrium between supply and demand with respect to real estate sales, pushing prices higher, so is the case with property rentals.

Short-term: The ever-popular short-term rental market is highly active with literally thousands of properties listed throughout the Costa del Sol. We are seeing owners renting their properties just for the lucrative high season and turning down long-term rentals. Last minute properties come on the market as late as May, June and July in a bid to cash in on late enquiries. High-end apartments are booked virtually all summer, with ‘Golden Mile Puente Romano beachside’ commanding over € 1,000 per night for a threebedroom apartment in July and August.

Long-term: There is a solid, long-term rental market in the city and nearby locations. Work opportunities and digital nomad tenants working from home have contributed to the sharp increase in demand and a diminished supply, making it hard to find a high-quality apartment in the key areas for less than €2,500 per month. Modern luxury villas are easily achieving over €15,000 per month and above. A major factor in the lack of supply of long-term properties is the lack of protection offered to the landlord by current rental laws.

Affordable Rentals For the working population in Marbella, rental apartments are now too expensive for average salaries. Minimum prices are around €1,200 per month – so areas outside Marbella, such as Estepona to the west, and Fuengirola to the east, as well as inland locations such as Monda and Coin, are benefitting from the demand as these are more affordable locations.

New Rental Markets Over the last decade, Marbella has been developing into a key European destination for events: weddings, corporate functions, reality shows, photoshoots, Netflix productions etc. Some of our most exclusive highend properties are attracting more bookings than in previous years.

Málaga Airport announced a record-breaking number of arrivals in the first six months of 2023, with over 10 million passengers during that period, surpassing the previous record year of 2019 by

High level tourism is not only important for the wealth it brings to Marbella, but has always been the first step towards introducing people to the area, many of whom later decide to purchase properties. It is an integral part of the model of residential tourism mentioned earlier, for which Marbella has been a pioneer since the mid-50’s.

In the first four months of 2023, Spain received a total of 21 million arrivals, 32.4% more than in the same period of 2022. Visitor and spending records were also broken in April: €8.48 billion, 22.7% more than the same period of 2022.35

Málaga Airport announced a record-breaking number of arrivals in the first six months of 2023, with over 10 million passengers during that period, surpassing the previous record year of 2019 by 9.2%.36

For the summer of 2023, there are a record number of 151 direct flights between Málaga airport and other cities in Europe, the Middle East, Africa and North America, a clear indication of the popularity of the Costa del Sol in tourism, with Marbella leading the way with respect to quality tourism.37

Marbella enjoyed several record months of hotel occupancy in the first half of 2023 with the highest figure since records began and even higher than 2019, considered a key year for the tourism sector. 38

The increase of 20% over 2019 of tourism segments such as golf (the province of Málaga with 52 golf courses, is already the Golf Capital of Europe) as well as nature tourism is also resulting in longer stays and higher-than-average spending per tourist.39

Despite the many problems around the world, confidence in Marbella’s future is at an all-time high. Marbella is in a much stronger position than ever before to deal with any lessened financial confidence that the future might bring, thanks to the substantial credibility and wealth generated by its many thousands of residents, tourists and investors on all levels who, together with good local governance, have made Marbella what it is today.

2. Demand will continue to be healthy, all other factors being equal. There is little sign of abatement to this demand for luxury properties. Notwithstanding, we expect the overall demand to gently decelerate to more normal levels.

3. Year-round activity. Marbella has evolved to a whole new level of activity and as a result, the low season has virtually ceased to exist. Big money has been betting on Marbella for over a decade and the post-covid boom has only reinforced the decision of all major investors to continue and increase their investments in this area.

4. Real estate supply is low compared to boom times of the past. With the lack of supply, rather than oversupply, there is no sign of the market overheating. There are, and will remain for the near future, shortages of many types of properties, especially the high end. Nevertheless, there are also many new and refurbished properties coming on line: the construction and sales of off-plan properties will no doubt accelerate.

5. Rising interest rates unlikely to affect demand for luxury Marbella property.As far as the luxury end of the market is concerned, probably 90% of sales are made without bank financing, so there will be little impact on the luxury end of the market attributable to the increase in interest rates.

6. Prices are still competitive compared to other luxury destinations. Prices in the ultra-prime areas have risen to record highs. But Marbella still remains competitive and indeed, has become for many people the “must” place to buy a second, or even a third, primary home. As indicated earlier, we believe that there will be a gentle levelling off of price increases in most areas.

7. The Marbella property market’s success includes neighbouring areas. Estepona, Benahavís and other neighboring municipalities along the whole Costa del Sol, will continue to enjoy an increasingly solid market, not only due to the factors described above, but also due to the outstanding features intrinsic to each of these areas.

8. Marbella’s reputation as a lifestyle destination has never been stronger. Despite uncertainty in some areas, the convergence of world events has clearly favoured the real estate market in the Marbella area, as demonstrated by the record period of growth we are experiencing. This has reinforced Marbella’s reputation as one of the most attractive places in Europe for quality living, and for the purchase and enjoyment of some of the highest quality properties available anywhere in the world.

Footnotes:

Copyright © 2023 Panorama Properties S.L – Special thanks to Cheryl Gatward, Alfonso Muñoz, Carolina Alaniz and Alex Clover for their assistance and tireless efforts in putting this report together